Australia continues to support first-time home buyers through various grants and schemes aimed at easing the financial burden of entering the property market. These initiatives are designed to assist individuals and families in securing their first home by providing financial aid and reducing upfront costs.

What is the First Home Buyer Grant?

The First Home Buyer Grant is a government initiative that provides financial assistance to eligible individuals purchasing their first home. The specifics of the grant including the amount and eligibility criteria can vary by state and territory. Generally the grant is a one-off payment to help with the costs associated with buying or building a new home.

Eligibility Criteria for the First Home Buyer Grant

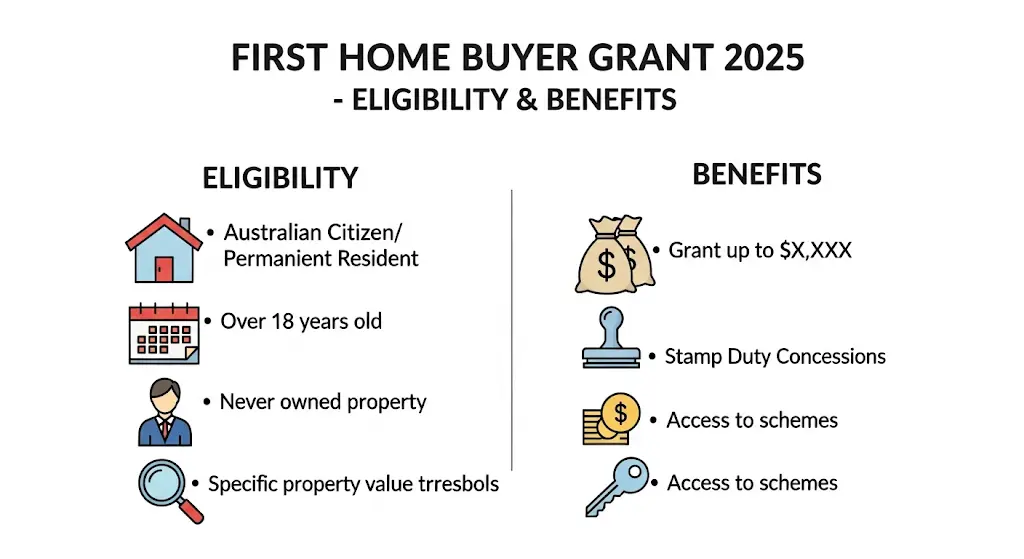

To qualify for the First Home Buyer Grant in 2025 applicants typically need to meet the following criteria:

- Age Requirement Applicants must be at least 18 years old

- Citizenship or Residency Applicants must be Australian citizens or permanent residents

- First-Time Buyer Status Applicants must not have previously owned or co-owned a residential property in Australia

- Property Use The property must be used as the applicant’s primary place of residence

- Property Value The value of the property must fall within the specified limits set by the state or territory

It’s important to note that these criteria can vary and it’s advisable to check with the relevant state or territory revenue office for the most accurate and up-to-date information.

Read Also: First Home Owner Grant Calculator

State and Territory Variations

Each Australian state and territory administers its own First Home Buyer Grant leading to variations in the amount of assistance and eligibility criteria. Here’s an overview:

- New South Wales (NSW) Eligible first-time buyers can receive a grant of up to $10,000 for purchasing a new home valued up to $600,000 or for a new house and land package valued up to $750,000

- Victoria (VIC) First-time buyers may be eligible for a grant of up to $10,000 for purchasing or building a new home valued at up to $750,000

- Queensland (QLD) The grant amount is up to $15,000 for purchasing or building a new home

- South Australia (SA) First-time buyers can receive a grant of up to $15,000 for purchasing or building a new home

- Western Australia (WA) The grant is up to $10,000 for purchasing or building a new home

- Tasmania (TAS) First-time buyers may be eligible for a grant of up to $20,000 for purchasing or building a new home

- Australian Capital Territory (ACT) The ACT offers a First Home Owner Grant of up to $7,000 for purchasing or building a new home

- Northern Territory (NT) First-time buyers can receive a grant of up to $26,000 for purchasing or building a new home

These amounts are subject to change and additional concessions or exemptions such as stamp duty relief may also apply.

Benefits of the First Home Buyer Grant

The primary benefit of the First Home Buyer Grant is the financial assistance provided to help cover the costs associated with purchasing or building a new home. This can significantly reduce the financial strain on first-time buyers and make homeownership more accessible.

Additionally some states and territories offer supplementary benefits such as stamp duty exemptions or concessions which can further reduce the overall cost of purchasing a property.

How to Apply

To apply for the First Home Buyer Grant applicants should:

- Check Eligibility Review the specific eligibility criteria for their state or territory

- Gather Documentation Prepare necessary documents such as proof of identity citizenship or residency status and details of the property transaction

- Submit Application Apply through the relevant state or territory revenue office either online or in person

- Await Approval Once the application is submitted await confirmation and processing

It’s advisable to apply for the grant as early as possible in the home-buying process to ensure timely assistance.

Important Considerations

- Timeframe for Occupation In most cases applicants must occupy the property as their primary place of residence within a specified period after settlement

- Repayment Obligations If the property is sold or rented out within a certain timeframe the grant may need to be repaid

- Combined Applications In joint applications all parties must meet the eligibility criteria